Radiology start-up Hexarad has become the first UK teleradiology company to offer a share scheme to its radiologists.

Radiologists reporting scans for Hexarad are invited to join an exclusive share scheme. There will be no buy-in required or any additional costs associated with owning the shares.

The share scheme has been set up in response to consultations with radiologists who described feeling valued, and being part of a reputable and expert team, as their top priorities.

Hexarad CEO, Dr Farzana Rahman, said: “We believe that offering our radiologists equity participation is going to be truly disruptive within the teleradiology marketplace.

“It will help to address key concerns voiced by radiologists, and help to make our reporters feel truly valued and rewarded for their expertise. Initial feedback from radiologists has been extremely positive, and we are expecting very strong participation as we launch the scheme.”

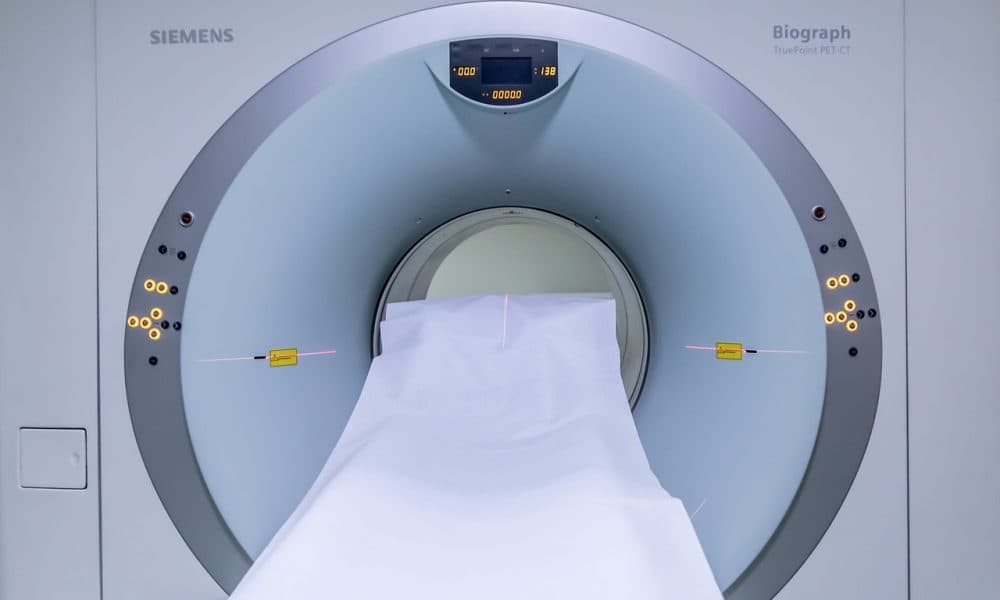

Hexarad has seen ever-increasing demand for its radiology services since the company was founded in 2016.

The ongoing global shortage of radiologists is putting increased pressure on healthcare services, especially as many are now dealing with significant diagnostic backlogs due to the COVID-19 pandemic. Delays to scan reporting lead to delayed diagnoses, resulting in poorer outcomes for patients.

Dr Rahman said part of the motivation behind setting up the share scheme has been the need for Hexarad to attract and retain high-quality radiologists to satisfy this high demand.

Hexarad’s intelligent end-to-end outsourcing solution has also been particularly in demand, as it not only provides high-quality remote reporting, but also offers a bespoke software solution, OptiRad, which helps radiology departments manage their workflow more efficiently.

Hexarad recently closed a £2.3m funding round which included a £1.7m growth capital investment from Foresight Group, the leading private equity and infrastructure investment manager.

This funding will enable the company to support more NHS and private healthcare customers, adding deeper capability and specialisation to its reporter network and further improving the technology which is core to its customer and radiologist experience.